Profile of vaccine developers

Of the confirmed active vaccine candidates, 56 (72%) are being developed by private/industry developers, with the remaining 22 (28%) of projects being led by academic, public sector and other non-profit organizations.

Although a number of large multinational vaccine developers (such as Janssen, Sanofi, Pfizer and GlaxoSmithKline) have engaged in COVID-19 vaccine development, many of the lead developers are small and/or inexperienced in large-scale vaccine manufacture.

So, it will be important to ensure coordination of vaccine manufacturing and supply capability and capacity to meet demand.

Most COVID-19 vaccine development activity is in North America, with 36 (46%) developers of the confirmed active vaccine candidates compared with 14 (18%) in China, 14 (18%) in Asia (excluding China) and Australia, and 14 (18%) in Europe.

Additional vaccine development efforts have been reported for China, and CEPI is in dialogue with the Chinese Ministry of Science and Technology to confirm their status.

Lead developers of active COVID-19 vaccine candidates are distributed across 19 countries, which collectively account for over three-quarters of the global population. However, there is currently no public information on vaccine development activity in Africa or Latin America, although vaccine manufacturing capacity and regulatory frameworks exist in these regions.

The epidemiology of COVID-19 might differ by geography, and it is likely that effective control of the pandemic will require greater coordination and involvement of the southern hemisphere in vaccine R&D efforts.

Type of vaccine:

Diversity of technology platforms

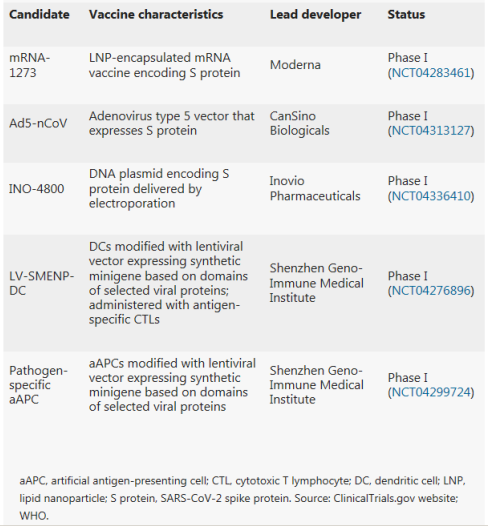

A striking feature of the vaccine development landscape for COVID-19 is the range of technology platforms being evaluated, including nucleic acid (DNA and RNA), virus-like particle, peptide, viral vector (replicating and non-replicating), recombinant protein, live attenuated virus and inactivated virus approaches.

Many of these platforms are not currently the basis for licensed vaccines, but experience in fields such as oncology is encouraging developers to exploit the opportunities that next-generation approaches offer for increased speed of development and manufacture.

It is conceivable that some vaccine platforms may be better suited to specific population subtypes (such as the elderly, children, pregnant women or immunocompromised patients). Considering the candidates, the novel platforms based on DNA or mRNA offer great flexibility in terms of antigen manipulation and potential for speed.

Indeed, Moderna started clinical testing of its mRNA-based vaccine mRNA-1273 just 2 months after sequence identification. Vaccines based on viral vectors offer a high level of protein expression and long-term stability, and induce strong immune responses.

Finally, there are already licensed vaccines based on recombinant proteins for other diseases, and so such candidates could take advantage of existing large-scale production capacity.